will child tax credit continue in 2022

Losing it could be dire for millions of children living at or below the poverty line. How much more money will i get in 2022.

Cuckoo On The Branch Cuckoo Clock Made In Italydefault Title In 2022 Cuckoo Clock Clock Cuckoo

Census Supplemental Poverty Measure report shows that the 2021 Child Tax Credit CTC reduced child poverty by 46.

. Losing it could be dire for millions of children living at or below the poverty line. Losing it could be dire for millions of children living at or below the poverty line. Parents who did not opt out of the monthly payments will get 1500 or 1800 per child depending on the childs age after they file their taxes in the spring of 2022.

Losing it could be dire for millions of children living at or below the poverty line. The future of the monthly child tax credit is not certain in 2022. The future of the monthly child tax credit is not certain in 2022.

This means that the credit will revert to the previous amounts of. The future of the monthly child tax credit is not certain in 2022. Democrats want to bring back Bidens child tax credit soon and a new report shows it was a huge success in fighting child poverty.

Child Tax Credit Payment Dates 2022. WASHINGTON Faith leaders pressed Congress to pass voting rights legislation a 15 minimum wage and a permanent expansion of the child tax credit during a Thursday. The future of the monthly child tax credit is not certain in 2022.

Losing it could be dire for millions of children living at or below the poverty line. So parents could only receive half their total child tax credit money 1800 or 1500 via those payments -- 300 per child per month under age 6 and 250 per child per. In 2022 the tax credit could be refundable up to 1500 a rise from 1400.

The new 2021 US. Losing it could be dire for millions of children living at or below the poverty line. The Child Tax Credit will continue in 2022 just without the expanded measures from the American Rescue Plan.

The future of the monthly child tax credit is not certain in 2022. In one year the expanded CTC. Currently the child tax credit is set to expire in 2022 Credit.

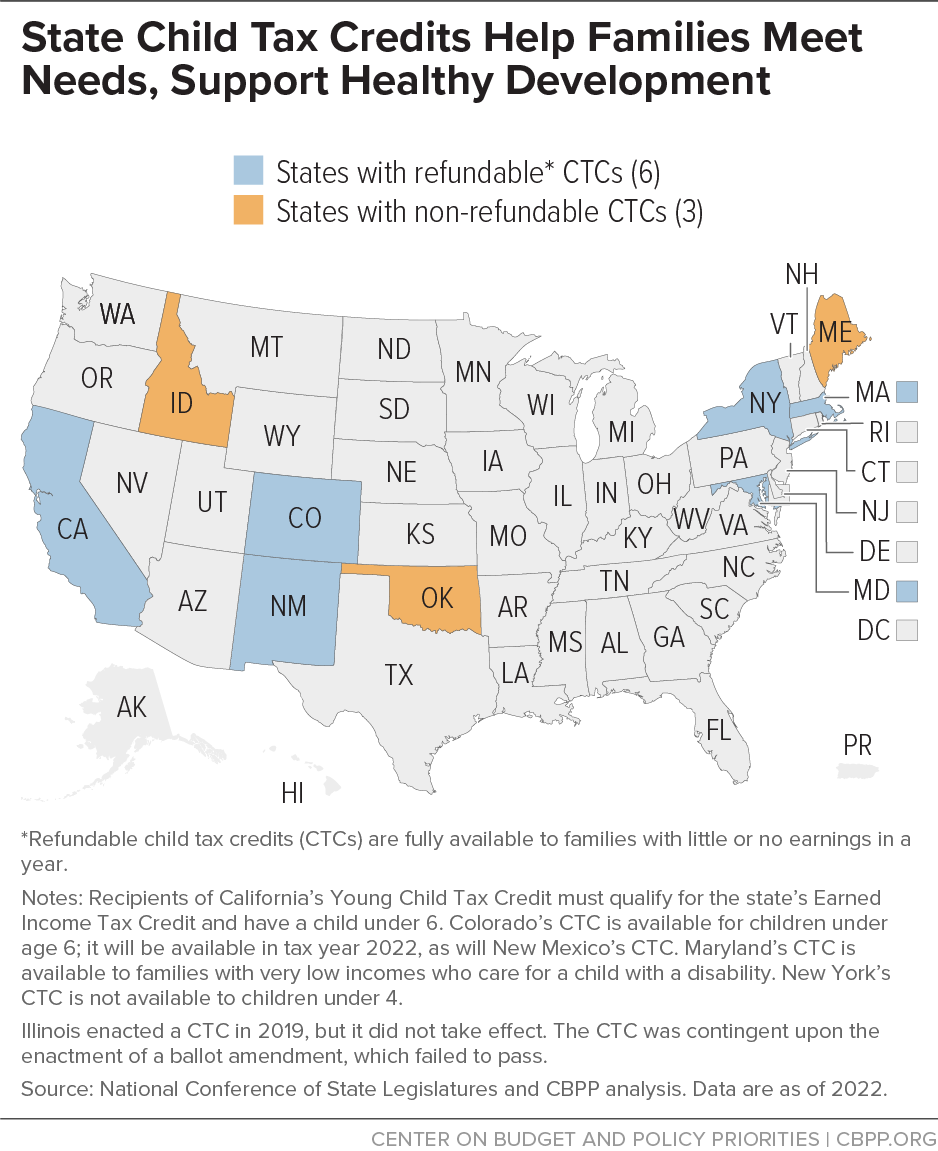

This year alone lawmakers in three states New Mexico New Jersey and Vermont created new CTCs while California policymakers meaningfully enhanced an existing credit. The second half of the 2021 CTC payment was to be claimed when filing your tax return in 2022 and paid according to the IRS refund processing schedule. The future of the monthly child tax credit is not certain in 2022.

Freeyearbooksyarncouk for the first time since july families are not expected to receive a. Faith leaders pressed Congress to pass voting rights legislation a 15 minimum wage and a permanent expansion of the child tax credit during a Thursday briefing on Capitol. The future of the monthly child tax credit is not certain in 2022.

The maximum child tax credit amount will decrease in 2022 In 2021 the enhanced child tax credit meant that taxpayers with children ages 6 to 17 could get a credit of up to. If you have a child under the age of 18 with a Social Security number you qualify for the child tax credit. The new child tax credit was included in Marchs American Rescue Plan Act and mandated that each eligible.

President Joe Biden motions while boarding Air. Losing it could be dire for millions of children living at or below the poverty line. That means the child tax credit returns to a 2000 lump sum for individuals making up to 200000 and couples filing jointly who make up to 400000 with 1400 refundable.

Fy 19 20 Income Tax Return E Filing Exemptions Deductions E Payment Refund And Excel Calculator Only 30 Second Income Tax Return Income Tax Tax Reduction

States Should Create And Expand Child Tax Credits Center On Budget And Policy Priorities

The Advance Child Tax Credit 2022 And Beyond

Child Tax Credit 2022 How Much Money Could You Get From Your State Cnet

2022 Nahma Ahma Education Event Calendar Nahma Education Event Calendar General Management

Will Monthly Child Tax Credit Payments Be Renewed In 2022 Kiplinger

Child Tax Credit Ending Will Push 10 Million Kids Back Into Poverty

Child Tax Credit 2022 Are Ctc Payments Really Over Marca

Child Tax Credit 2022 Are Ctc Payments Really Over Marca

Fy 19 20 Income Tax Return E Filing Exemptions Deductions E Payment Refund And Excel Calculator Only 30 Second Income Tax Return Income Tax Tax Reduction

Child Tax Credit Will There Be Another Check In April 2022 Marca

Department Of Historic Resources Rehabilitation Tax Credits Historic Homes Staunton Virginia Is For Lovers

/cdn.vox-cdn.com/uploads/chorus_asset/file/23979823/bigbill.jpg)

Will Child Tax Credit Payments Continue In 2023 The Fight Is Not Over Vox

Next Generation Business Models Creating Value Mckinsey In 2022 Healthcare System Virtual Care Health Care

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/23979603/GettyImages_1358862218a.jpg)

Will Child Tax Credit Payments Continue In 2023 The Fight Is Not Over Vox

Child Tax Credit 2022 How To Claim A Missed Payment Before Tax Deadline Marca

Stimulus Updates To Know For Spring 2022

Impressive Boost For New Homes In Central Manchester As High Demand Continues Apace In 2022 Block Of Flats Skyscraper High Rise Building

Legislative Momentum In 2022 New And Expanded Child Tax Credits And Eitcs Itep